Business transactions were recorded in specialized journals or ledgers. Getting Data Into the General Ledgerįor centuries, bookkeeping was done with paper and pen. To record payment on invoice 21095 from Ace Design, Inc. Two days later, she receives payment on that invoice: To record invoice 21095 for Ace Design, Inc. On January 12, Sally completes a consulting project for Ace Design, Inc.

To record payment on invoice 4987 from OfficeMart To record payable for invoice 4987 from OfficeMart Here’s the journal entry to record the receipt of the supplies and the related payable: Payment on that invoice is due in 14 days. When the supplies are delivered, she also receives invoice number 4987 from OfficeMart. On January 10, 2020, Sally ordered $238.87 worth of office supplies from OfficeMart. The combination of the accounting equation and the actions of debiting or crediting an account means that the different categories of accounts will normally have either a debit balance or a credit balance. Over on the income statement, revenue accounts are increased by credits, and expense accounts are increased by debits.

Crediting an asset account decreases the balance, while crediting a liability or equity account increases it. Debiting an account on the right side of the equation - a liability or an equity account - will decrease the balance in that account.Ī credit amount has the opposite effect. This means that debiting an account on the left side of the equation - an asset account - increases that account. Using this equation, debits are recorded on the left, and credits on the right. Journal entries must also be consistent with the general accounting equation which describes the balance sheet: Under the double-entry bookkeeping method, debits and credits in a journal entry must be equal. A reference number that serves as a unique identifier for the transaction.

The account name and number for each account impacted.That way, instead of only having account balances, we can look back at journal entries to see what really happened and if anything was recorded incorrectly.Ī journal entry has the following components:

One important key to journal entries is that they need to contain enough information to clearly reflect the actual transaction.

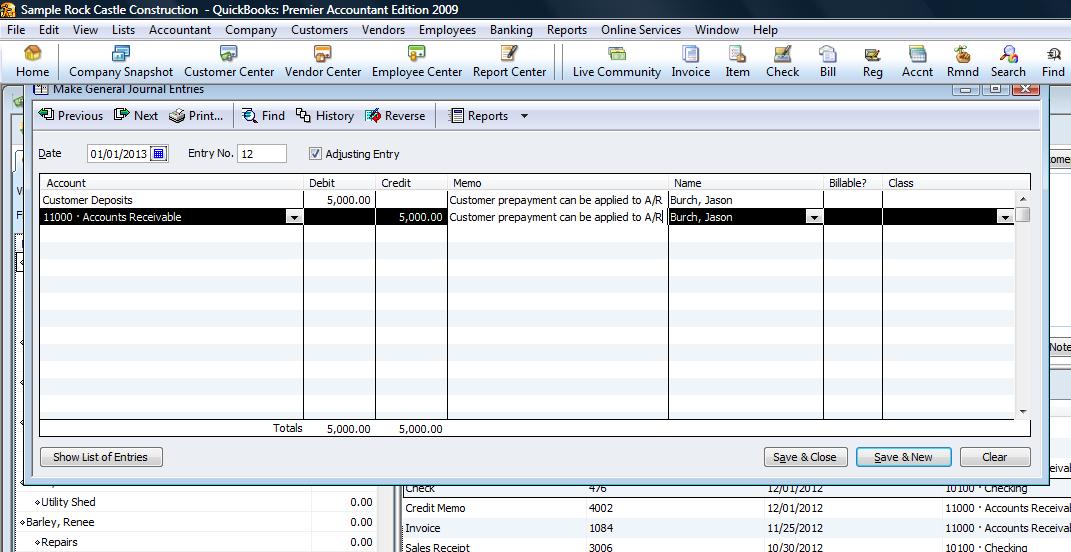

Journal entry to clear invoice pro 2016 manual#

While most of this process happens behind the scenes in modern accounting software, it’s important to know what’s going on and there are times when manual entries will need to be made to correct or adjust account balances at the end of an accounting period. In the day before all this automation, entries were made manually into journals, which may have been Excel sheets but at one point were actual physical books of paper (like a journal!)Īccounting journal entries are used to record financial transactions in the accounting system, and would be transferred from the journals and posted to the general ledger. In the age of automated accounting software, it can be easy to forget the role of the humble journal entry. Before we get ahead of ourselves, let’s start with the basics. For example, when a business buys supplies with cash, that transaction will show up in the supplies account and the cash account. The double-entry accounting method requires every transaction to be recorded in at least two accounts. They make it possible to track what a business has used its resources for, and where those resources came from. Journal entries form the building blocks of the double-entry accounting method that has been used for centuries to keep financial records. Working with the former accountants now working at FloQast, we decided to take a look at some of the pillars of the accounting profession.Ī journal entry records a business transaction in the accounting system for an organization.

Journal entry to clear invoice pro 2016 how to#

Accounting What is a Journal Entry in Accounting? Definition & How to

0 kommentar(er)

0 kommentar(er)